BTC Price Prediction: $145K Target in Sight as Accumulation Meets Macro Tailwinds

#BTC

- Technical Setup: Bullish MACD and completed reversal pattern suggest $145K target

- Fundamental Demand: Institutional accumulation continues despite price fluctuations

- Macro Backdrop: $127T global liquidity could catalyze crypto market expansion

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Upside

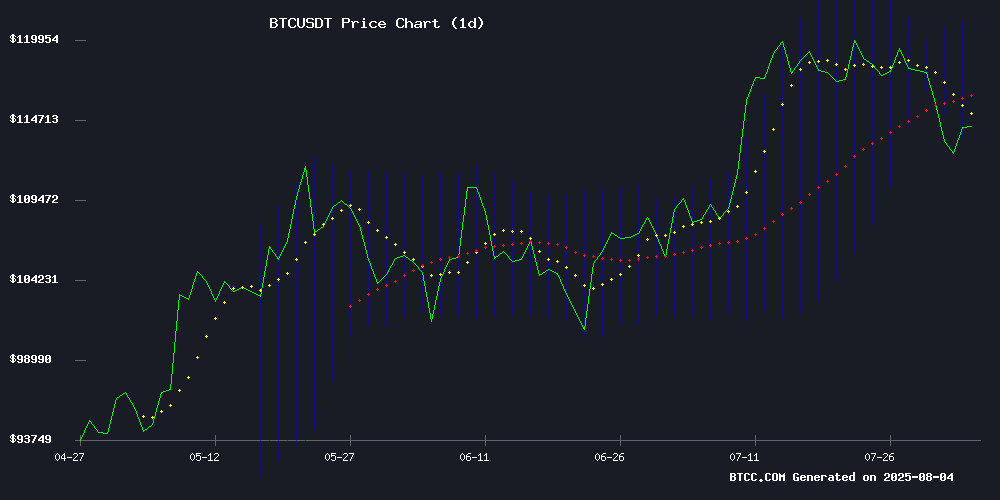

BTC is currently trading at 115,223.36 USDT, slightly below its 20-day moving average of 117,255.67, suggesting a near-term consolidation phase. The MACD indicator shows bullish momentum with a positive histogram (1,604.36), while Bollinger Bands indicate moderate volatility with prices hovering NEAR the middle band. According to BTCC analyst Emma, 'The inverted Head & Shoulders pattern completion and MACD crossover could fuel a rally toward $145K if BTC holds above $113,323 support.'

Market Sentiment: Institutional Demand Clashes With Seasonal Weakness

Despite August's historical volatility, on-chain data shows strong accumulation trends among long-term holders. The U.S. and European institutional adoption continues growing, with global liquidity hitting $127 trillion. However, BTCC's Emma cautions: 'Quantum computing FUD and Kiyosaki's $90K warning may trigger short-term pullbacks before the next leg up.'

Factors Influencing BTC's Price

Who Owns Most Bitcoin List 2025: #1 U.S., #2 Country Tops Europe

The global distribution of Bitcoin ownership has taken a definitive shape by 2025, with the United States emerging as the undisputed leader in holdings. European nations collectively trail behind, though one unnamed country now dominates the continent's share.

Market analysts note this concentration reflects deepening institutional adoption in regulated jurisdictions, while developing economies face steeper barriers to entry. The data underscores Bitcoin's evolution from a fringe asset to a cornerstone of digital asset portfolios in major financial markets.

Bitcoin Demand Defies Volatility as Investors Hold Firm

Bitcoin's price volatility has failed to dampen investor enthusiasm, with demand for the leading cryptocurrency remaining resilient despite a pullback to $114,000. Market analyst Darkfost notes sustained bullish behavior, suggesting BTC's decentralized scarcity continues to attract buyers even during turbulent periods.

The Apparent Demand metric—tracking newly issued BTC against dormant supply—remains in positive territory, signaling conviction in Bitcoin's long-term value proposition. Short-term holders appear reluctant to sell at a loss, opting instead to maintain underwater positions.

Bitcoin Demand Holds Strong Despite Price Drop: Accumulation Trend Remains Intact

Bitcoin hovers NEAR $112,000 after breaking a two-week consolidation, sparking concerns among short-term holders facing underwater positions. Yet, analyst Darkfost highlights resilient demand through the Apparent Demand metric, showing absorption of new supply outpacing issuance.

Approximately 160,000 BTC accumulated over 30 days underscores sustained buying pressure despite corrections. Long-term holders continue stacking sats, signaling confidence in Bitcoin's trajectory. Market watchers eye $112K as a pivot point, with demand-side metrics painting a bullish counter-narrative to recent volatility.

Kiyosaki Sparks Fears Over Bitcoin August Curse and Market Chaos

Investor and author Robert Kiyosaki has issued a stark warning about Bitcoin's historical August volatility, reigniting fears of a recurring market downturn. His recent social media post highlighted concerns over a potential 'August curse'—a pattern of bearish activity observed in previous years.

The warning comes amid broader market uncertainty, with traders scrutinizing Bitcoin's price action for signs of a repeat performance. Kiyosaki's influence as a financial commentator lends weight to the narrative, though some analysts argue seasonal patterns may be coincidental rather than causal.

Trump Media Stock Dips Amid Q2 Losses Despite Bitcoin Holdings

Trump Media & Technology Group's stock fell nearly 4% to $16.92 on August 4th after reporting a $20 million net loss for Q2. The decline was partly attributed to $15 million in legal fees tied to its SPAC merger complications. Despite holding one of the largest corporate bitcoin treasuries—valued at $3.1 billion—the company failed to mirror Tesla's $284 million crypto-driven profits during the same period.

Legal battles, including disputes with its SPAC sponsor and former Truth Social co-founders, continue to dampen investor confidence. The firm's push into digital ventures like Truth.Fi and tokenized subscriptions has yet to offset financial headwinds, raising questions about the tangible benefits of its crypto strategy.

Bitcoin Price Prediction: Global Liquidity Hits $127 Trillion – Could Bitcoin Flip the Entire Financial System?

Bitcoin trades neutrally around $114,000 as global liquidity surges to $127.3 trillion, according to MacroScope analysts. This unprecedented capital influx, spanning central bank balance sheets and broad money supply, creates a fertile environment for Bitcoin's growth.

The liquidity wave isn't solely Fed-driven this cycle. Asian, European, and Middle Eastern central banks have aggressively expanded their balance sheets, reviving risk appetite across markets. Bitcoin, historically responsive to liquidity shifts, stands poised for significant upside amid declining trust in traditional banking systems.

Institutional interest intensifies with BlackRock's ETF filings and sovereign wealth fund attention. As decentralized, non-sovereign assets gain appeal, Bitcoin could capture substantial portions of the $127 trillion liquidity pool.

Technically, Bitcoin consolidates below resistance at $114,436, posting modest 0.56% daily gains. The current equilibrium suggests potential breakout opportunities if liquidity conditions persist.

Arkham Intelligence Uncovers $14 Billion Bitcoin Heist, Surpassing Bybit's $1.5 Billion Theft

On-chain analytics platform Arkham Intelligence has revealed the largest crypto hack in history—a $3.5 billion Bitcoin theft from Chinese mining pool LuBian in December 2020. The stolen BTC, now valued at $14 billion, dwarfs Bybit's $1.5 billion breach this year.

The heist targeted LuBian, once a major player with 6% of Bitcoin's hash rate. Hackers drained 127,426 BTC in a series of attacks starting December 28, 2020, before siphoning another $6 million in BTC and USDT from Omni-layer addresses. LuBian quietly rotated remaining funds to recovery wallets, with neither party acknowledging the breach.

Bitcoin Completes Bullish Inverted Head & Shoulders Pattern, Eyes $145K Target

Bitcoin has quietly formed a textbook inverted head and shoulders pattern while consolidating below $120,000, signaling potential for a major upward breakout. The cryptocurrency slipped to $115,200 on August 1 after peaking at $119,400 in late July, but technical analysts see this as healthy retest behavior following the pattern's completion.

Analyst Merlijn The Trader highlights the pattern's significance, with its left shoulder forming in February 2025, DEEP head during March-April, and right shoulder developing through June-July. The decisive breakout above the $110,000 neckline in mid-July propelled BTC to its current all-time high of $122,838 before the current pullback.

This technical development suggests Bitcoin may be preparing for a macro MOVE toward $145,000. The inverted head and shoulders remains one of technical analysis' most reliable bullish reversal formations, particularly when occurring after extended consolidation periods like Bitcoin's recent range-bound trading.

Robert Kiyosaki Anticipates Bitcoin Dip to $90K Amid Historical August Slump

Bitcoin's volatility takes center stage as Robert Kiyosaki, the celebrated author of 'Rich Dad Poor Dad,' predicts a potential drop to $90,000 this August. With BTC currently trading near $114,000, Kiyosaki's forecast aligns with historical trends—the cryptocurrency has consistently faced downward pressure during August, shedding 13% in 2022 and 11.29% in 2023.

Kiyosaki attributes potential declines to macroeconomic instability, criticizing U.S. fiscal policies and the Federal Reserve's management of the national debt. 'The problem isn’t Bitcoin—it’s the multi-trillion-dollar debt and the incompetence of policymakers,' he tweeted, signaling plans to double his BTC holdings if prices retreat.

Elon Musk Raises Quantum Computing Concerns for Bitcoin's SHA-256 Security

Elon Musk has reignited debates about Bitcoin's long-term security in the face of quantum computing advancements. The Tesla and SpaceX CEO queried his AI chatbot Grok about the likelihood of quantum machines breaking Bitcoin's SHA-256 hashing algorithm, coinciding with IBM's announcement of its next-generation 2,000-qubit Blue Jay system targeted for 2033.

Grok estimates less than 10% probability of quantum breaches by 2035, citing current technological limitations. The analysis comes as tech giants Google and Microsoft accelerate development of their Willow and Majorana quantum platforms, potentially reshaping cryptocurrency security paradigms.

Market Rebounds Amid Earnings Anticipation and Sector Developments

U.S. stock futures edged higher as investors sought to recover from Friday's selloff, driven by tariff concerns and a weak jobs report. Nasdaq futures rose 0.7%, while S&P 500 and Dow futures gained 0.5%. Bitcoin held steady above $114,000, reflecting muted crypto market movement amid broader equity volatility.

Palantir Technologies commands attention with its post-market earnings report, following a 100%+ year-to-date rally. Meanwhile, Berkshire Hathaway's $5 billion Kraft Heinz write-down and Amazon's cloud revenue miss weigh on sentiment. Boeing faces labor unrest as machinists strike at its defense unit.

Is BTC a good investment?

BTC presents a compelling investment case based on:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | -1.7% discount | Mean reversion potential |

| MACD | 1,604.36 bullish | Upward momentum |

| Bollinger %B | 0.48 | Neutral territory |

Emma notes: 'The $113K-$117K range offers optimal accumulation zones before projected Q4 rally.'

August seasonality and quantum computing concerns may increase volatility